Sudhir Bapusaheb Devkar, an IT department employee at Mindtree, found himself on the wrong side of the law when a seemingly harmless trade in his employer’s stock spiralled into a financial nightmare. His case serves as a stark reminder of the complex and often misunderstood regulations surrounding insider trading. Devkar’s dream of supplementing his income through day trading was shattered when he was penalized ₹1 lakh for trading in his employer’s stock without proper disclosure.

“I have always worked in the area of engineering and technology and have never had any knowledge of any areas of finance concerning the company,” Devkar said in response to an order by markets regulator Securities and Exchange Board of India (Sebi), dated 29 June 2022. “These provisions were not widely publicized for a layman like me to know that such a provision exists.”

Despite his plea, Sebi imposed the minimum penalty of ₹1 lakh for the offense.

According to Abhishek Dadoo, partner at Khaitan and Co., these rules are designed to prevent those with unpublished price-sensitive information (UPSI) from short-changing unsuspecting investors. However, this incident illustrates how individuals without knowledge of these regulations can inadvertently find themselves penalized.

In August 2020, Sebi had sent a letter to Mindtree, requesting a list of individuals subject to its insider trading regulations. This inquiry revealed that Devkar had traded Mindtree stock on three separate occasions without disclosure. At that time, employees had to report trades exceeding ₹10 lakh in their employer’s shares within two trading days. Sebi has since updated its regulations, replacing “employees” with “designated persons.”

In this article, we will address key questions to help employees avoid violating regulations.

View Full Image

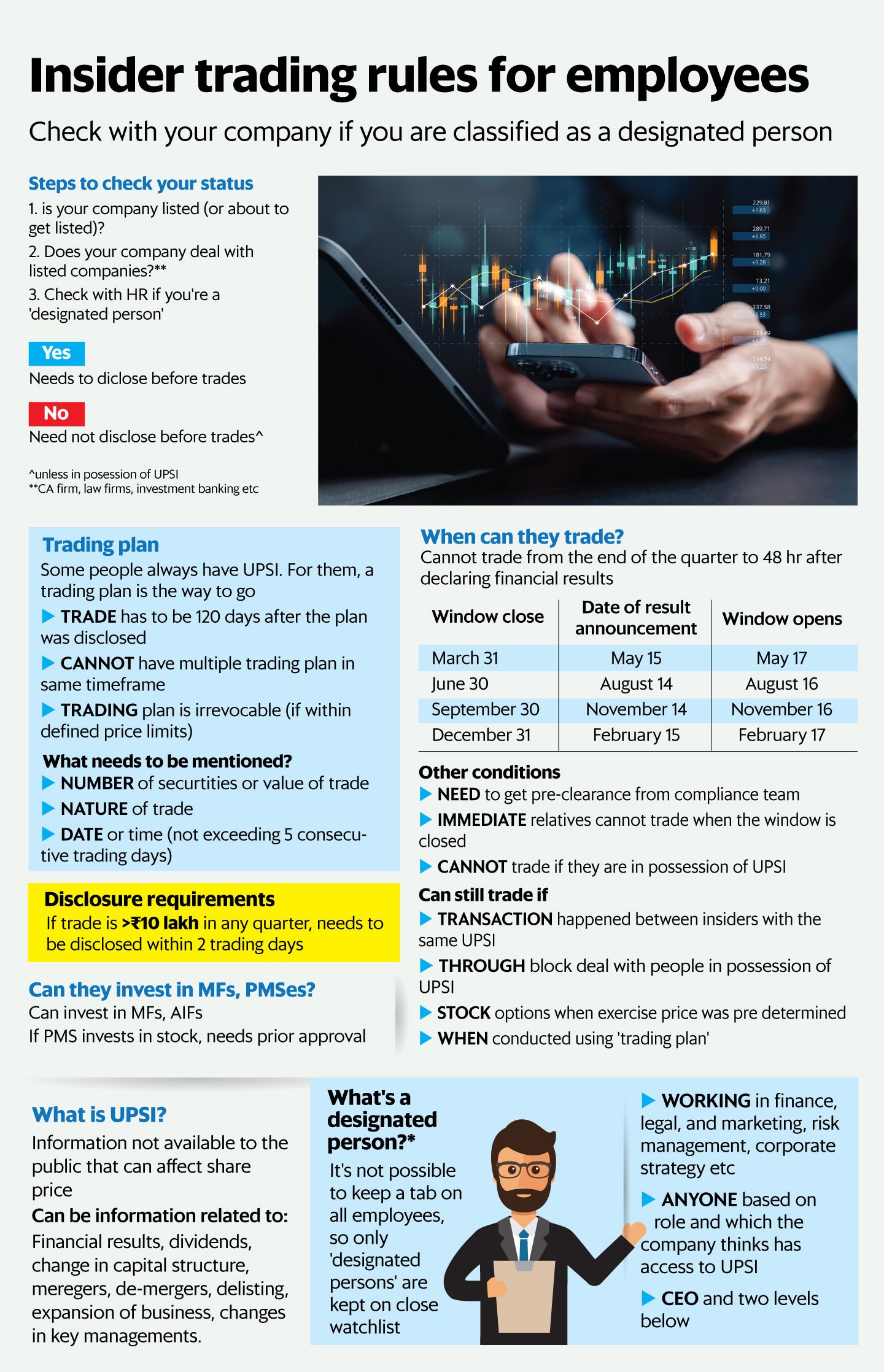

Who are ‘designated persons’?

If you work for a listed company, the first step is to determine whether you are classified as a ‘designated person.’ In large companies like Reliance Industries Ltd or Infosys Ltd, it is challenging to monitor every employee.

Read this | Mint Explainer: How Sebi wants to prevent insider trading violations

Thus, Sebi mandates that only select employees, designated by their role, function, and access to UPSI, are bound by strict disclosure norms. The board of directors identifies these ‘designated persons,’ typically employees two levels below the chief executive and others with significant access to UPSI.

“Every company can decide who they want as a designated person,” Dadoo said. “On a lighter note, sometimes an employee carrying tea can have as much UPSI as someone in admin or day-to-day operations.”

Trading restrictions

Designated employees, along with promoters, directors, and others covered under the regulations, can only trade in their company’s stock when the trading window is open. They and their immediate relatives are prohibited from trading when the window is closed, from the end of every quarter until 48 hours after the financial results are announced.

Exceptions are made for trades between insiders with the same UPSI, stock options with pre-determined exercise prices, and pre-approved trading plans (see Grfx). Companies may require pre-clearance for trades above a certain threshold—Infosys, for example, sets this at ₹5 lakh. Pre-clearance expires after seven days, and contra-trades are forbidden for the next six months.

To seek pre-clearance, applicants must declare they do not possess any UPSI. Top executives like CEOs or promoters, who have constant access to UPSI, may use a trading plan. Additionally, designated persons must disclose any trades exceeding ₹10 lakh within two days. Stock exchanges have surveillance mechanisms to detect and report suspicious trades to Sebi.

“If you are an employee and trading in the stocks without disclosure, then the onus is on them to prove their innocence. If the trade was carried by an outsider, the burden is on the complainant to prove that the person is guilty,” Dadoo explained.

The regulations also cover trades by immediate relatives, such as parents and spouses. There are two categories: those financially dependent on the designated person and those who are not. Dadoo advises that financially dependent relatives should avoid trading in the company’s stock to prevent complications. For non-dependent relatives, caution is still recommended if there is potential UPSI.

Do relatives come under the purview?

Dadoo said that the regulations extend to trading by immediate relatives, such as parents and spouses. These relatives fall into two categories: those who are financially dependent on the designated person and those who are not.

He advised that financially dependent relatives should avoid trading in the company’s stock to prevent any potential complications. For non-dependent relatives, the situation is more complex. To avoid unnecessary issues, Dadoo recommends that they also refrain from trading in the company’s stock if there is potential UPSI with the employee.

What about external parties?

Third-party firms often have access to sensitive information during significant transactions or financial announcements. For example, when Reliance Industries acquired Just Dial, the lawyer handling the contract details would have known about the deal and could potentially benefit from this information. Similarly, chartered accountants, insolvency professionals, consultants, bankers etc assisting or advising listed companies have access to critical financial information about public companies.

More here | Religare chief broke insider trade laws: Burmans

The market regulator mandates that such entities formulate a formal code of conduct to avoid insider trading. Dadoo said the “same approach applies to any person/third party in possession of UPSI.”

Safer investment alternatives

Experts suggest investing through mutual funds to stay on the safe side of Prohibition of Insider Trading regulations.

Also read | Sebi’s seven measures to tame the “tail that’s grown bigger than the dog”

The key rule is to determine whether you have control over the underlying securities of the fund. Alternative Investment Funds (AIFs) are treated similarly to mutual funds since both are pooled investment vehicles, and unitholders do not influence the fund manager’s choices. Conversely, Portfolio Management Services (PMS) are akin to holding shares in a personal account, as investors can override the fund manager’s decisions. If a PMS fund manager purchases stock in your employer’s company, you could be held accountable.