This discussion led us to explore the concept of professional tax in India, a tax that many, especially the self-employed, might not even realise they need to pay.

Professional tax is a state-imposed tax and is not just limited to professionals. Those earning an income through a profession, trade, or employment, whether salaried or self-employed, are liable to pay it.

“Professional tax is levied by state governments and is mandatory for individuals regardless of whether they are employees or self-employed professionals,” explained chartered accountant Prakash Hegde. “In case of employees, a threshold will be given on the basis of income and in case of self employment, experience could be one of the criteria. The tax is capped at ₹2,500 per year, as stipulated by Article 276 of the Indian Constitution.”

The tax operates differently for salaried employees and self-employed professionals or consultants. For salaried employees, the employer deducts the tax based on income slabs defined by each state and remits it to the state government on behalf of the employee. However, self-employed individuals, including consultants, must manage these payments on their own.

“Self-employed professionals have to register and pay the tax themselves, typically before 30 April every year,” Hegde.

This tax has been part of India’s tax system since 1949, with the maximum limit initially capped at a mere ₹250 per annum. However, an amendment in 1988 raised this limit to ₹2,500, a figure that remains unchanged till date.

View Full Image

State variations

Article 276 gives state governments the authority to levy and collect professional tax. The way the tax is applied can differ significantly for states, leading to a complex web of rules and rates across the country.

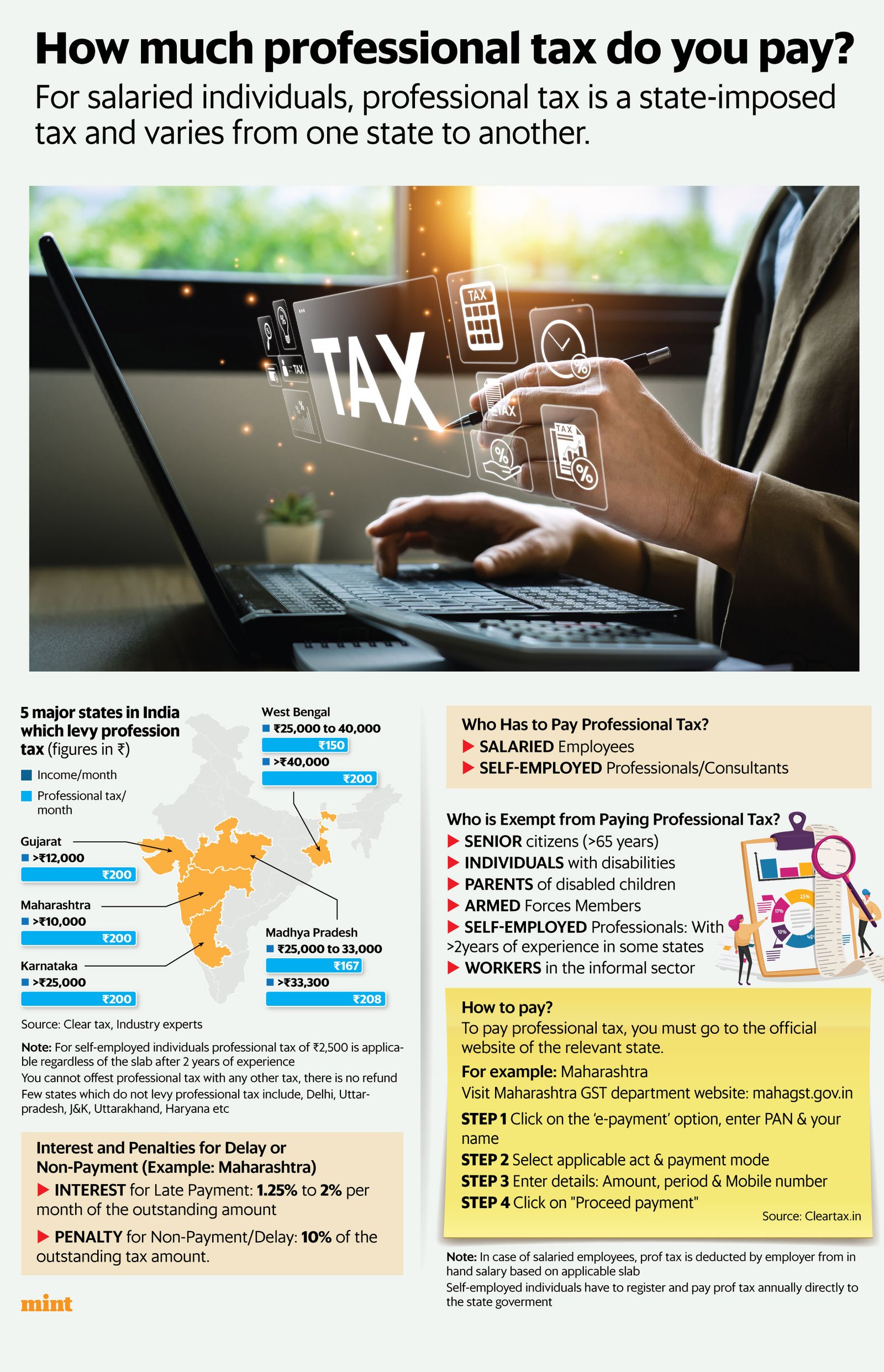

Most states that levy professional tax have slab-based rates, meaning the amount you pay depends on your income (refer to the graphics).

In states like Maharashtra, Karnataka, and West Bengal, the tax is collected monthly, with the total annual amount capped at ₹2,500. However, some states, such as Delhi, Haryana, and Uttar Pradesh, do not levy professional tax at all. Thus, it is important to check your state’s specific regulations.

Exemptions are available for certain individuals, such as senior citizens above 65 years of age, parents or guardians of mentally disabled children, individuals with permanent physical disabilities, and members of the armed forces.

“For self-employed and consultants with less than two years of experience, professional tax is not mandatory,” Hegde said.

Paying professional tax

To pay professional tax, it is important to first register with your state’s tax department if you are self-employed. After registration, payments can usually be made online through the state’s designated portal. It is advisable to keep track of your payment deadlines to avoid any penalties or interest charges.

For example, in Maharashtra, the penalties for professional tax non-compliance are as follows: a late registration penalty of ₹5 per day, a monthly interest rate of 1.25-2.00% for late payment, a 10% penalty on the tax amount for non-payment or delays, and a penalty of ₹1,000 for late return submission.

Challenges in compliance

One of the challenges in paying professional tax is the process itself. Each state has a designated portal for tax payments, but technical issues sometimes make the payment process cumbersome.

“If you fail to pay professional tax, the tax department will send a reminder and a notice. Many a times, the notice may come after a few years as well,” said Hegde. On the other hand, if you don’t have a GST number, it can be more challenging for authorities to detect non-payment, but the obligation remains.

It is important to note that professional tax cannot be offset against any other tax and must be paid in full. Many, particularly the self-employed, may be unaware of their obligation, but compliance is key to avoiding penalties.

“Understanding and complying with professional tax regulations is essential to avoid penalties and ensure that you are on the right side of the law,” Hegde said.

Conclusion

Professional tax is a significant part of the state tax system in India, applicable to anyone earning an income. Whether you are an employee or a self-employed professional, understanding how this tax works is vital to meeting your legal obligations and avoiding penalties.