Traditionally, mutual fund distributors earn commissions from asset management companies (AMCs) for selling their products. In contrast, Scripbox’s fee-based model aims to eliminate commissions by charging clients directly for advisory services.

For context, users can still buy mutual funds on the platform without paying any upfront advisory fees, but in this case, the platform sells them regular mutual funds. These funds have a higher total expense ratio (TER) because the AMC pays commissions to the distributor for each purchase. Equity schemes typically have higher expense ratios, followed by debt and liquid funds.

Read this | Mint Explainer: How Sebi is cracking down on unregistered investment advisors

Popular brokerage firms like Groww and Zerodha Coin offer direct plans without advice, leading many users on these execution-only platforms to buy trending or high-return funds out of greed or lack of knowledge—a strategy investment experts consider risky.

View Full Image

Vishal Dhawan, a registered investment adviser and founder of Plan Ahead Wealth Advisors, emphasized the importance of advisory services. He noted that many investors on execution-only platforms tend to chase past top performers, leading to imbalanced portfolios. Recently, a significant portion of mutual fund (MF) inflows has been directed towards thematic and small-cap funds, driven by past performance. Dhawan suggests that advisory services can help investors create more balanced portfolios, avoiding the pitfalls of chasing trends.

More here | Where are India’s missing investment advisers?

As investors increasingly demand transparency and personalized financial guidance, Scripbox’s model is trying to tap those seeking advice and not just execution. While many platforms offer direct mutual fund plans, Scripbox distinguishes itself by pairing these with advisory services.

“The fee looks attractive but the platform might decide to hike the price like every other startup in the later stage,” said Dhawan

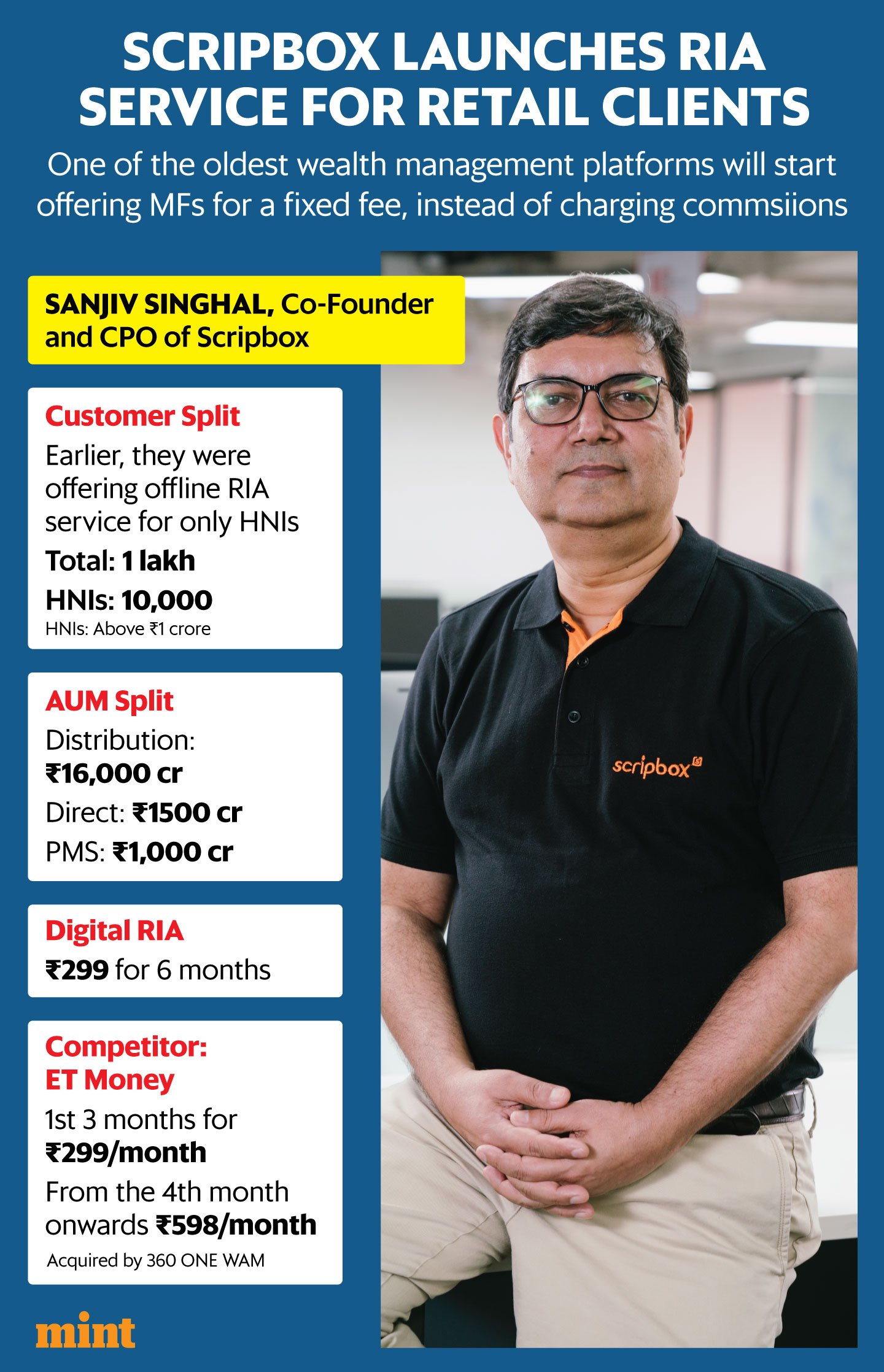

The platform’s new monthly RIA plan, priced at ₹299 for six months, provides commission-free direct plans and expert advice. For non-RIA clients, the same advisory service is extended but with commissions from asset management companies (AMCs) for regular plans.

Scripbox’s initiative appears to be a pilot to determine if the RIA model can be scaled for the broader market. ET Money, now part of 360 ONE, also offers an RIA service called ‘Genius,’ charging Rs. 299 per month for the first three months, with tailored mutual fund and stock portfolios.

“Investors in direct funds lack access to expert guidance, this is a significant gap in the market which we are addressing with our app,” said Sanjiv Singhal, founder, Scripbox. “Our digital app provides personalized financial planning, risk profiling, asset allocation, fund selection, portfolio review—end-to-end high-quality advisory services—for investors in direct funds. This is what we do best—helping our customers meet their long-term financial goals.”

However, convincing Indians to pay out of pocket for advice remains challenging. For decades, investors have been used to paying indirectly through commissions. ET Money’s Genius service, under the RIA code, has roughly 76,000 users paying ₹254 each month, compared to 900,000 users on the execution-only plan with no advisory fee.

“Bringing very cheap financial advice to the masses is difficult and not profitable, at least so far,” said Kavitha Menon, an individual RIA and founder of Provitus Wealth. “Robo-advisory usually is impactful only when combined with a human touch.”

Regulatory challenges have also limited the RIA service mostly to high net-worth clients. Scripbox previously offered RIA services exclusively to high-net-worth individuals, managing ₹1,500 crore for 10,000 clients under advisory compared to ₹16,000 crore for 100,000 clients under the distribution license.

Founded in 2012, Scripbox was among the first digital wealth management platforms. It has experienced rapid growth since 2020, primarily through acquisitions in the mutual fund distribution space.

Also read | How a Japanese makeover is driving Nippon India MF’s growth, rankings

Currently, Scripbox manages an estimated ₹18,500 crore in assets, a surge from ₹1,700 crore in August 2020. The growth is partly the result of acquiring smaller offline distribution businesses.