It’s a growing trend in the corporate world for mid- to senior-level employees to switch to consulting roles. Typically, the conversion happens in the company they were employed with full-time. The key reasons are a guaranteed gig and the tax benefits, say experts.

“The income that you were earning as salary is now treated as business income. This gives you the option of switching to the presumptive taxation scheme that can save more tax over what you can save on salary,” said Pranjal Bansal, a partner at AAPT Associates, a chartered accountancy firm.

However, this is not as straightforward as it sounds.

What makes you a consultant?

Experts point out that the tax department will not treat you as a consultant just because the company updates the employment letter to label you a consultant without changing the other terms of the job such as work timings and leave entitlements.

“If the contract defines the consultant’s work hours and the leave they are allowed to take, the roles and responsibilities remain unchanged and most importantly, bars them from taking up other projects, it is still considered employment by the tax and provident fund authorities,” said Prakash Hegde,a CA and principal consultant of direct taxation at Acer Tax & Corporate Services LLP. “Many companies use this route to avoid paying provident fund and other employment-related benefits. The Supreme Court, in many cases, has ruled that such contracts constitute employment.”

Switching roles on paper shouldn’t be seen as a tax-saving scheme that one should take up blindly.

How tax is saved

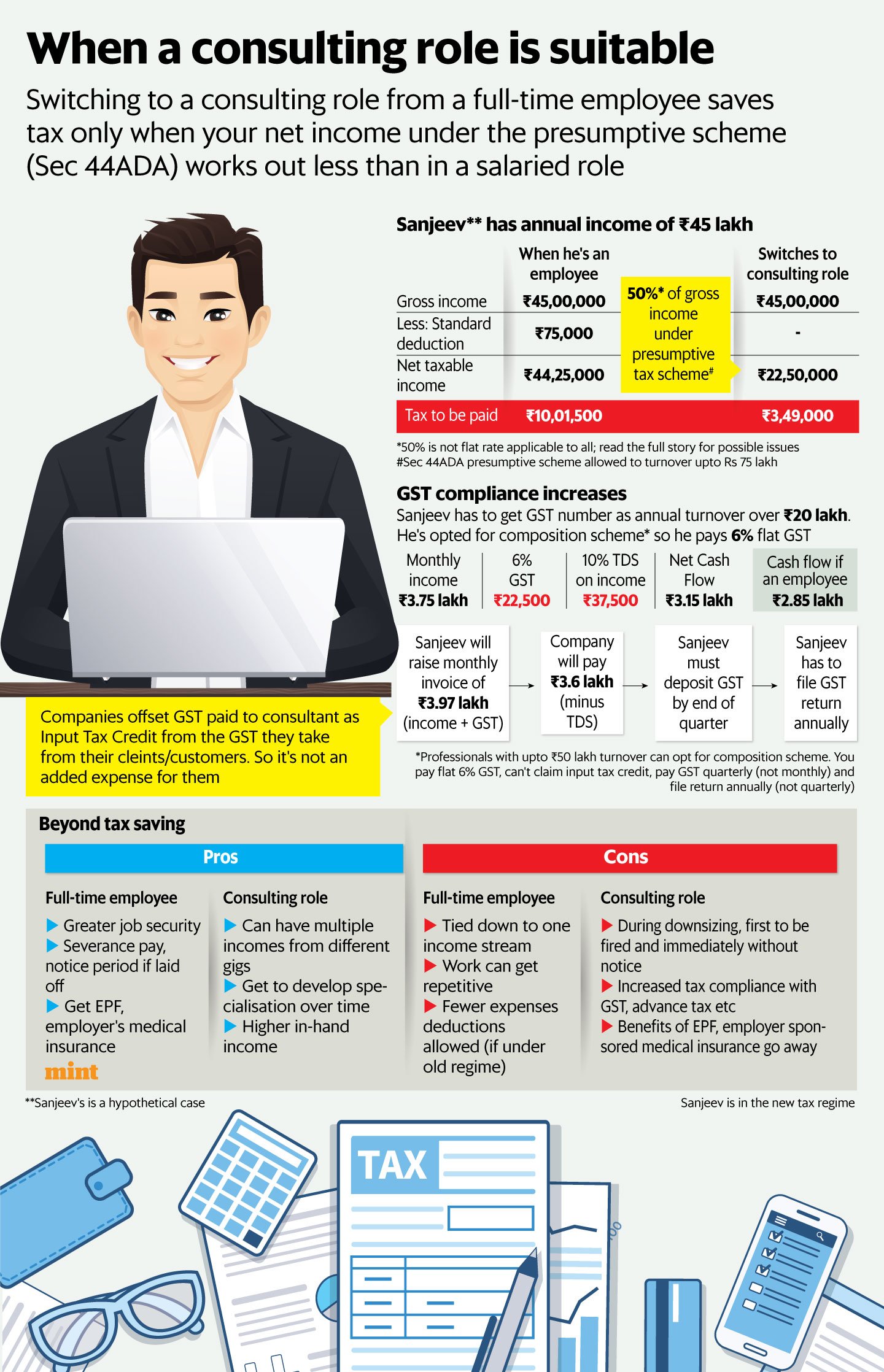

The biggest draw of taking on a consulting role is the option of the presumptive taxation scheme. A consultant qualifies as professional service provider and hence can choose the presumptive taxation scheme under Section 44ADA.

Under this section, the taxpayer is allowed to straightaway offer 50% and more of gross revenue as taxable income at the relevant slab rate. The assumption is that the remaining income covers expenses incurred by the taxpayer, which are not to be taxed.

A professional is also not required to maintain books of accounts or be audited under the presumptive scheme. This saves you the hassle of recording each expense and claiming them later while filing taxes. The catch is that a flat 50% of the income is not to be offered to tax in all cases.

“Though it’s a common practice, it is a fallacy,” said Gautam Nayak,a partner at CNK & Associates.“Taxable income should actually be arrived at by deducting the actual expenses one has incurred. It includes both personal and professional expenses. The case shouldn’t be that you show ₹25 lakh of your ₹50 lakh turnover as income to be taxed, whereas you have made investments worth ₹30 lakh. Logically, how can you invest more than your income?”

Karan Batra, founder of Chartered Club, agreed.

“Now AIS (annual information statement) shows your investments and big-ticket expenses, which makes it easier to tally,” Batra said.

The tax department has so far not flagged any cases with such discrepancy, and hence declaring 50% income continues to be the norm. Hegde said it’s an unsettled law as many tribunals have ruled that if the law itself permits taxpayers to not maintain books of accounts and offers the minimum permissible income to tax, i.e., 50%, the tax department cannot question the taxpayer.

How much tax is reduced?

As a consultant, you will save tax when the tax-saving components in your CTC (cost to company) are lower than the expenses you are able to deduct under the presumptive taxation scheme.

View Full Image

For instance, Mr A is a salaried employee with gross income of ₹40 lakh and he claims ₹5 lakh as house rent allowance (HRA), ₹6 lakh on car lease and ₹1.5 lakh as Section 80C deductions under the old tax regime. With standard deduction, he gets ₹13 lakh in tax deduction and his tax liability stands at ₹6.35 lakh.

Now, if Mr A was to switch to a consulting role with the same gross income, this is how his expenses would look. His rent works out to 15% of his income. Assume he spends another 35% on utilities and other professional expenses. He can offer 50% of his income to tax, i.e., 20 lakh. He has to pay ₹4.25 lakh in tax, which is about ₹2.1 lakh less.

On the same assumptions, Mr A will pay less tax as a consultant even if he declares up to 70% as taxable income.

Take note that since Mr A is under the old regime, he can further claim medical insurance premium, home loan interest and other deductions on his salary income.

The other factor to consider is that when one switches to a consultant role, gross income typically increases by 30-100%, as per industry estimates, especially when you take up multiple gigs.

On the flipside, if a taxpayer prefers the new tax regime, for incomes from ₹51 lakh to ₹75 lakh – the maximum income up to which presumptive taxation is allowed – the presumptive taxation scheme will reduce the net taxable income below the ₹50 lakh threshold above which 10% surcharge applies.

The taxpayer should consider all these factors before taking the decision.

Where an individual’s professional expenses are over 50% of salary, it would make sense to switch to a consulting role but not opt for presumptive tax. This is because the taxpayer can deduct all such expenses as business related, which would not be allowed in a job.

Added GST compliance

Being a consultant also means you have to get a GST registration number when the annual income exceeds ₹20 lakh. This increases tax compliance because you need to pay GST each month, calculate how much input tax credit (ITC) you can claim, and file returns periodically. ITC is the GST that you have paid on expenses related to your work and can be offset from your own GST liability.

“The need to engage a CA increases when you have GST. For a salaried employee, the employer deposits the TDS and the employee only has to file ITR annually,” said Batra.

For those with turnover up to ₹50 lakh, there’s relief in the composition scheme offering a lower GST rate. Service professionals pay a flat 6% GST but can’t claim any ITC. Experts say individual consultants and freelancers have fewer business expenses and corresponding ITC to claim, so the composition scheme works out better for them. Compliance too reduces in this scheme as GST is to be paid quarterly and filed annually.

Beyond tax

The decision to forgo the safety of a job shouldn’t depend only on how much tax you can save.

Foremost, you lose out on employees’ provident fund (EPF) and company-sponsored medical insurance. As a consultant, you can continue PF through the Public Provident Fund scheme.

One must also analyse the impact of this switch on their career. Devashish Chakravarty, founder of SalaryNext.com, a job loss assurance company, said even if you are in a consulting contract with the same company, you could be the first to be terminated in a downsizing exercise.

“In the case of employees, the company is liable to give them a notice period or pay severance, or both. There’s usually no such liability for consultants, so their contracts can be closed immediately,” he said.

The upside is that consulting roles open up opportunities to earn more as you can take up many gigs. Further, since the overall cost to the company usually reduces when you become a consultant, it is advised that you negotiate better pay.

“Employers prefer to pay a higher per-hour rate to consultants in lieu of the job security, income guarantee and CTC benefits that they give employees. You can usually earn 30-100% more on a per hour rate for the same tasks,” said Chakravarty.

Apart from saving tax, one should also look at it as an opportunity to specialise in one’s field of expertise.